Physical Stock Verification: The Missing Layer in Modern ERP Systems (2026 Complete Guide)

Enterprise Resource Planning systems have transformed how businesses manage inventory. From real-time stock updates to automated financial postings, modern ERP platforms promise accuracy, control, and efficiency. Yet despite decades of ERP adoption, one persistent problem remains unsolved:

System inventory rarely matches physical stock on the ground.

This gap is not caused by weak software. It exists because ERPs were never designed to verify physical reality. They manage data, transactions, and processes. Physical stock verification lives outside that digital layer.

In 2026, this disconnect is no longer a minor operational issue. It has become a strategic, financial, and compliance risk.

What Modern ERP Systems Do Well

Before discussing what is missing, it is important to understand what ERPs actually excel at.

Modern ERP systems are built to:

- Record inventory movements such as goods receipt, issues, and transfers

- Maintain real-time system stock balances

- Integrate inventory with finance, procurement, and production

- Enable planning, forecasting, and reporting

- Enforce standardized processes across locations

- Generate valuation reports and closing stock statements

- Automate accounting entries for inventory movements

For managing what should exist, ERPs are extremely powerful.

However, ERPs assume that the data entered into the system is correct. They do not independently verify physical stock.

That assumption creates a structural blind spot.

The Reality on the Warehouse Floor

Warehouses and factories operate in imperfect environments. Real-world inventory is influenced by human behavior, operational pressure, and environmental factors.

Common causes of mismatch between ERP and actual stock:

- Human errors during picking, issuing, or receiving

- Unrecorded damages, spillages, or wastage

- Delayed system entries due to operational urgency

- Theft or pilferage

- Incorrect storage locations

- Batch mislabeling

- Unit of measurement errors

- Process deviations during peak operations

- System back-dated entries

Over time, these small discrepancies accumulate.

The ERP continues to reflect system truth, while physical stock slowly drifts away from it.

Without structured stock verification, organizations discover problems only during:

- Year-end audit of inventory

- Unexpected stockouts

- Financial closing mismatches

- Production stoppages

By then, corrective action becomes expensive and reactive.

Why ERP Inventory Alone Is Not Enough in 2026

Inventory complexity has increased significantly in 2026.

Businesses now manage:

- Multi-location warehouses

- Faster fulfillment cycles

- Higher SKU complexity

- Tighter compliance standards

- Increased audit scrutiny

- Higher inventory carrying costs

- Volatile global supply chains

In this environment, relying solely on ERP inventory creates serious risks.

Key Risks of Missing Physical Verification

- Financial misstatements due to inaccurate closing stock

- Production delays caused by hidden shortages

- Excess working capital locked in phantom inventory

- Audit observations and compliance failures

- Loss of operational trust between systems and teams

- Poor demand planning decisions

- Margin leakage

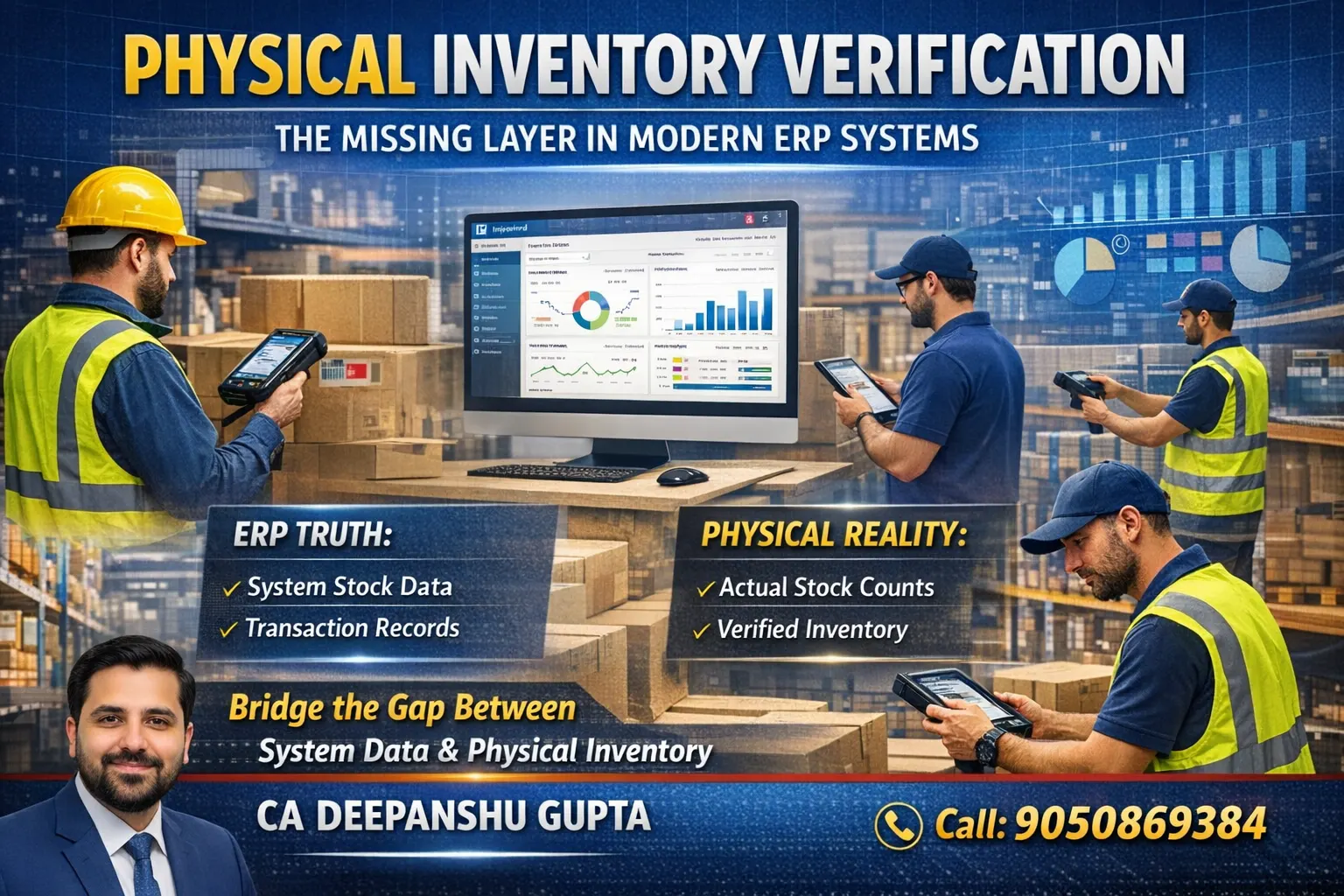

Modern ERP answers:

“What does the system believe exists?”

Physical verification of stock answers:

“What actually exists?”

Both are required. One without the other is incomplete.

What Is Physical Inventory Verification?

Physical inventory verification is the structured process of validating actual stock on the ground and reconciling it with system records.

It involves:

- Counting physical stock at defined storage locations

- Capturing who verified it, when, and how

- Identifying variances between physical and ERP stock

- Creating traceable evidence for audit of inventory

- Feeding verified data back into ERP systems

Unlike inventory management, verification is not continuous tracking. It is controlled validation at critical checkpoints.

Typical Use Cases of Physical Stock Verification

- Cycle counts

- Periodic stock audits

- Year-end inventory audits

- Warehouse handovers

- Compliance-driven reconciliations

- Pre-merger inventory validation

- Insurance verification

Manual Stock Verification: Why It Fails in 2026

Traditionally, physical verification of stock has been handled using:

- Paper sheets

- Excel templates

- Ad-hoc scanner uploads

- External audit teams with disconnected tools

Limitations of Manual Verification

- High dependency on individual discipline

- No real-time visibility

- Delayed variance detection

- Limited audit trail

- Error-prone data consolidation

- Weak accountability

- Difficult evidence tracking

- Risk of data manipulation

Manual methods treat stock verification as an event.

Modern operations require it to be a structured, repeatable, digital process.

The Missing Layer: Digital Physical Inventory Verification

A digital physical inventory verification layer sits between the warehouse floor and the ERP system.

It acts as a bridge between reality and recorded data.

It does not replace the ERP.

It strengthens it.

What This Layer Enables

- Mobile-based on-ground verification

- Time-stamped and user-mapped counts

- Location-wise validation

- Structured verification workflows

- Automated variance identification

- Audit-ready reports

- Controlled ERP reconciliation

- Role-based access control

- Real-time management dashboards

Instead of discovering discrepancies weeks later, businesses gain immediate visibility.

ERP vs Verification Layer: Role Comparison

| Feature | Modern ERP | Physical Verification Layer |

|---|---|---|

| Transaction Management | Yes | No |

| Financial Integration | Yes | Limited |

| Planning & Forecasting | Yes | No |

| Physical Count Execution | No | Yes |

| Variance Detection | Limited | Yes |

| Audit Trail for Physical Counts | Limited | Strong |

| On-Ground Accountability | No | Yes |

| Real-Time Physical Visibility | No | Yes |

Together, they form a complete inventory integrity framework.

Why Audit of Inventory Failures Are Increasing

Auditors in 2026 demand more than summary sheets. They require:

- Evidence of who counted stock

- Time-stamped verification records

- Location-based reconciliation

- Variance justification trail

- Digital documentation

Common audit observations include:

- Inadequate physical verification

- Unsupported stock adjustments

- Weak internal control over inventory

- Delayed variance reporting

- Incomplete audit trail

Without structured physical stock verification, businesses face:

- Qualified audit opinions

- Increased compliance risk

- Regulatory scrutiny

- Financial reporting corrections

Strategic Benefits of Physical Stock Verification

Operational Benefits

Early detection of shrinkage

Reduced production disruption

Improved warehouse discipline

Better demand planning accuracy

Compliance Benefits

Stronger audit of inventory outcomes

Evidence-backed reconciliation

Reduced regulatory risk

Governance Benefits

Increased management confidence

Improved internal control framework

Clear accountability mapping

Physical Verification Framework for 2026

To build a future-ready verification process, organizations should implement:

1. Structured Cycle Counting

ABC classification-based frequency

Risk-weighted counting schedule

Surprise verification programs

2. Digital Workflow Integration

Mobile-enabled verification

Role-based approvals

Automated variance escalation

3. Accountability Mapping

User-linked count records

Supervisor verification

Audit log storage

4. ERP Reconciliation Control

Approved adjustment workflow

Segregation of duties

Variance trend analysis

Where Taxation Consultancy Fits In

Taxation Consultancy is designed specifically to act as this missing verification layer.

Instead of managing inventory movements like a modern ERP, it focuses on verifying physical reality.

How Taxation Consultancy Strengthens Inventory Governance

- Enables structured physical inventory verification

- Captures verification data directly from warehouse floors

- Maintains strong audit trails

- Identifies variances in real-time

- Supports clean ERP reconciliation

- Works ERP-neutral across platforms

- Strengthens audit of inventory compliance

By working alongside existing ERP systems, Taxation Consultancy transforms stock verification from an afterthought into a controlled governance layer.

2026 Trends Making Stock Verification Non-Negotiable

1. Increased Audit Scrutiny

Regulators expect traceability, not assumptions.

2. Distributed Warehousing

Remote operations require digital visibility.

3. Faster Supply Chains

Speed increases error probability.

4. Margin Sensitivity

Inventory inaccuracies directly affect profitability.

5. AI-Based Planning

AI forecasts fail when base data is inaccurate.

Garbage data in → wrong planning out.

The Strategic Conclusion

Modern ERP systems are powerful.

But they were never built to see the warehouse floor.

Physical inventory verification fills that gap. It transforms inventory accuracy from an assumption into a controlled, auditable process.

In 2026, businesses that treat stock verification as a core governance layer — not a periodic activity — gain:

- Higher trust in data

- Stronger audit outcomes

- Better financial control

- Improved operational decisions

- Reduced financial risk

The future of inventory control is not just digital.

It is digitally verified.

And with structured verification solutions like Taxation Consultancy, organizations can finally bridge the gap between system truth and physical reality — creating inventory integrity that stands up to audit scrutiny, regulatory compliance, and strategic growth.

Name : CA DEEPANSHU GUPTA

Contact Number : 9050869384

FAQ'S

What is physical stock verification?

Physical stock verification is the process of counting actual inventory and reconciling it with ERP records to identify discrepancies and ensure accurate financial reporting.

Why is physical verification of stock important?

It prevents financial misstatements, improves operational accuracy, strengthens audit of inventory outcomes, and reduces working capital risk.

How often should stock verification be conducted?

Best practice includes:

- Daily cycle counts for high-value items

- Monthly verification for critical SKUs

- Quarterly review for moderate-risk inventory

- Annual full inventory audit

What happens if inventory mismatches are ignored?

Ignoring mismatches can result in:

- Audit qualifications

- Financial misstatements

- Production stoppages

- Revenue loss

- Compliance penalties

How does Taxation Consultancy improve audit readiness?

Taxation Consultancy creates structured verification workflows, time-stamped evidence, variance tracking, and audit-ready documentation that strengthens inventory governance.

What is the difference between stock verification and inventory management?

Inventory management tracks movements and balances in ERP.

Stock verification confirms whether physical inventory matches system records.

What is stock verification?

Stock verification is the structured process of physically counting inventory and reconciling it with ERP records to detect variances and ensure financial accuracy.

Why is physical verification required in modern ERP systems?

Modern ERP systems manage transactions but cannot confirm actual stock on the warehouse floor. Physical verification ensures inventory integrity and audit compliance.

What are the risks of not conducting audit of inventory properly?

Risks include financial misstatements, audit qualifications, stock shortages, margin loss, and regulatory scrutiny.